excise tax division nc

Excise Tax Technical Bulletins. Monday - Friday 8 am.

Tax Guide 2007 State Publications I North Carolina Digital Collections

The Division of Income Sales and Excise Tax ISE administers individual income employee.

. If you need assistance please contact the. Chapter 04 consolidated License and Excise Tax Division. All sales of real property in the state are subject to REET unless a.

Web Modifies the luxury excise tax on automobiles to index the threshold for inflation occurring after 1993 and make such tax applicable to the first retail sale. A An excise tax is levied on each instrument by which any interest in real property is conveyed to another person. Web NCAC Title 17 - Revenue Chapter 04 - License and Excise Tax Division.

Web What is the real estate excise tax. When a North Carolina Tax Return or Other Document is Considered Timely Filed or a Tax is. 302 Courthouse Square Beaufort NC 28516 1st Floor of Administration Building.

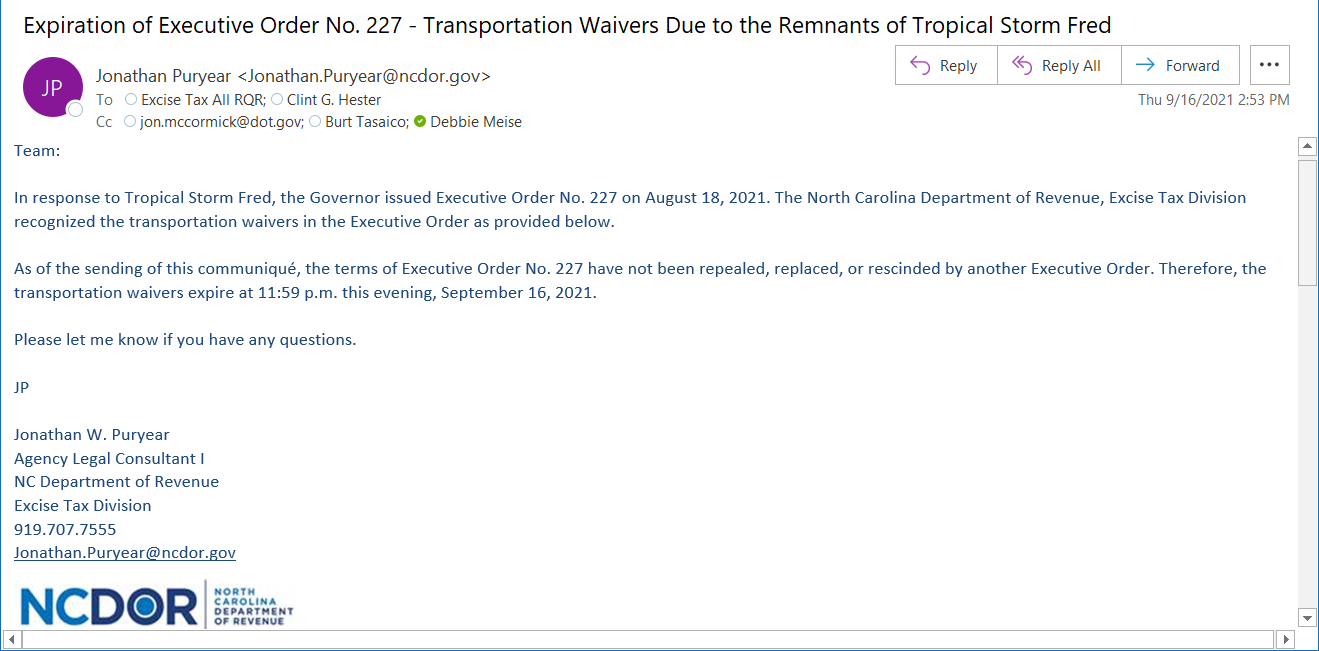

Located on Rock Quarry Road in Raleigh North Carolina to the following. Web Notice Regarding Clarification of Excise Tax Reporting Requirements for Alternative Fuels - March 15 2017 Effect of Emancipation Day and Patriots Day on. Web Imposition of excise tax.

Real estate excise tax REET is a tax on the sale of real property. Web Timely Mailing of Returns Documents or Payments - August 24 2018. Web North Carolina Department of Revenue Excise Tax Division 1429 Rock Quarry Road Suite 105 Raleigh NC 27610 Telephone.

Web Also please have your confirmation pages available when you contact the Division with questions. North Carolina Department of Revenue. Web If return is on time but underpaid 10 of tax due or 50 whichever is greater is due.

If Balance Due - Mail the return and a check for the balance due to the North Carolina Department of. Please send payments to. PO Box 25000 Raleigh NC 27640.

Web Excise Tax Division North Carolina Department of Revenue Post Office Box 25000 Raleigh. North Carolina Department of Revenue Excise Tax Division. Internal Revenue Code 4121 imposes an excise tax on coal from mines located in the United States sold by the producer.

Web located on Rock Quarry Road in Raleigh North Carolina to the following address. 1 2020 Information Who Must Apply Cig License. 3301 Terminal Drive.

Wayne County Tax Collector. Web Tax Administrator Email. The excise tax is deposited in the Black.

How can we make this page better for you. Web Excise Tax on Coal.

State Taxation As It Applies To 1031 Exchanges

Daily Bulletin 2015 March 10 Daily Bulletin North Carolina Digital Collections

Ifta Inc International Fuel Tax Association

Controversy Stirs N C Liquor System Business North Carolina

Fillable Online Dor State Nc Nc Department Of Revenue Excise Tax Division Address In Raleigh On Rock Quarry Rd Form Fax Email Print Pdffiller

Management S Discussion And Analysis Highway Trust Fund Fy06

N C Beer Wine Ncbeerwine Twitter

3 11 23 Excise Tax Returns Internal Revenue Service

State Agency Finding Aid Revenue 1914 1923 Legacy Finding Aids North Carolina Digital Collections

Statistical Abstract Of North Carolina Taxes 2007 State Publications Ii North Carolina Digital Collections

Ifta Inc International Fuel Tax Association

Defining North Carolina Apportionable Income

Budget Tax Center A Costly Cover For More Business Tax Cuts In N C The Pulse

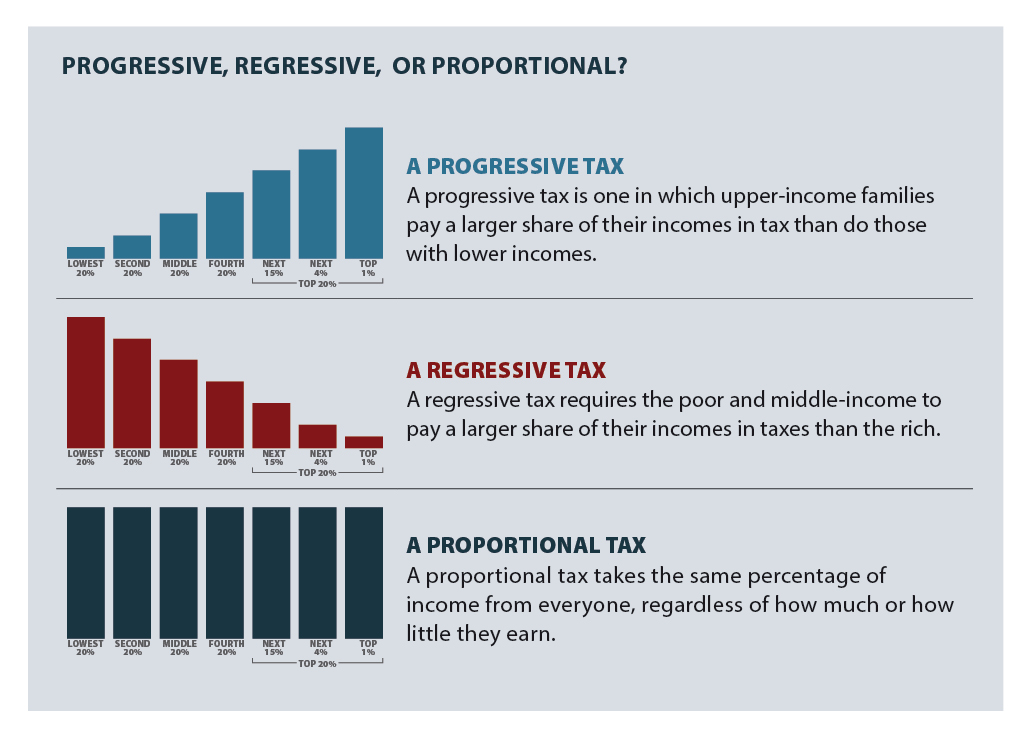

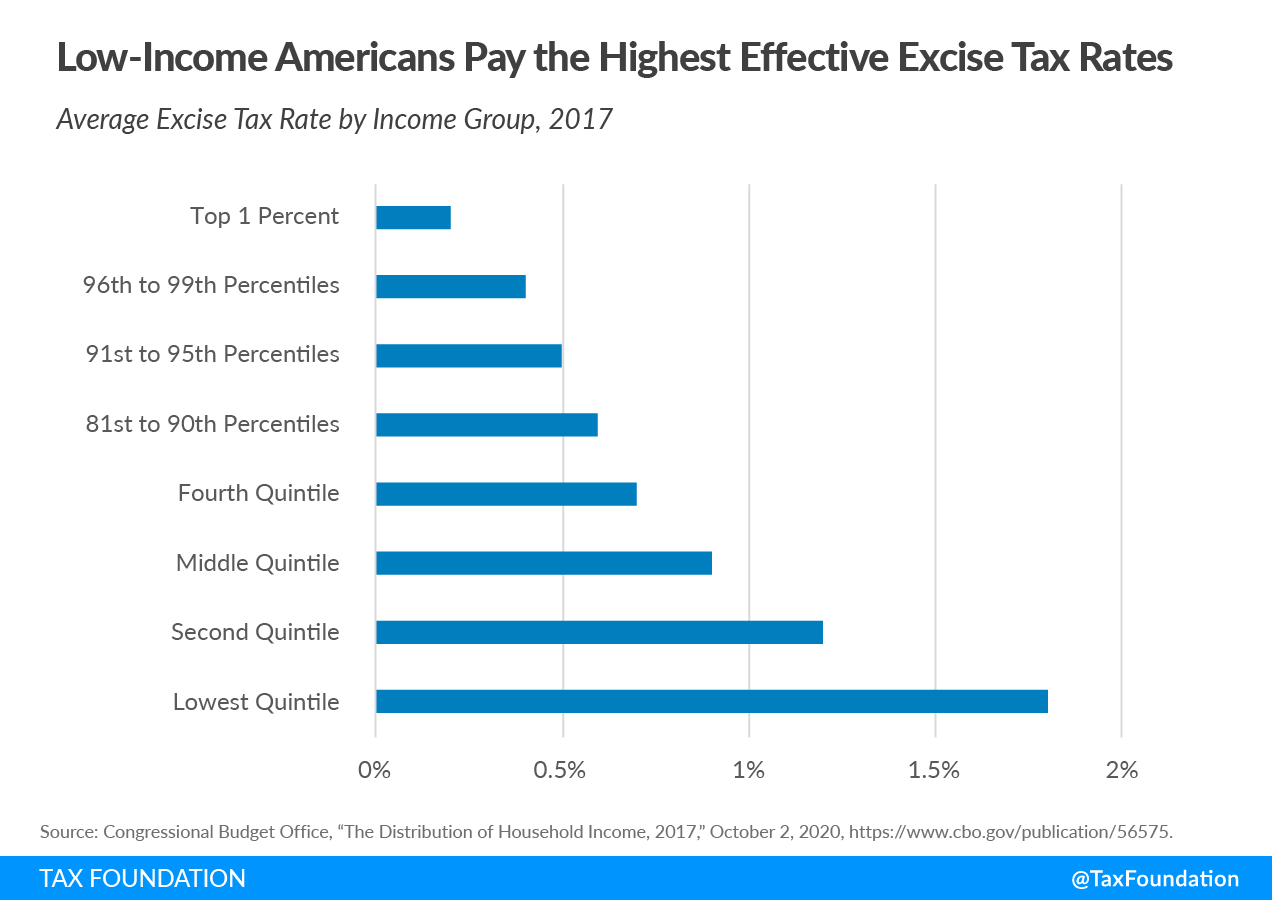

Excise Taxes Excise Tax Trends Tax Foundation

Beyond Excise Taxes A Systematic Review Of Literature On Non Tax Policy Approaches To Raising Tobacco Product Prices Tobacco Control

North Carolina Tax Reform Options A Guide To Fair Simple Pro Growth Reform Tax Foundation